Contents:

I begin this pcandlesticks for dummies by setting candlesticks in context with several other types of charts, so you can get a feel for candlestick benefits. After that, I explain the price action and signals that candlestick charts generate, and I show you how a candlestick is constructed and what its variations can mean. To close Part I, you look at the range of electronic resources available for candlestick charting, which you can exploit with just a few clicks of your mouse.

I’ve organized Candlestick Charting For Dummies into five parts. Each part offers a different set of information and skills that you can take away to incorporate in your personal trading strategy. You get a feel for candlestick basics or understand some simple candlestick patterns and how to trade based on them. You tackle some more complicated patterns and figure out how it’s possible to use candlesticks in tandem with other popular technical indicators.

Book preview

During the next three years, Lewis rose from callow trainee to bond salesman, raking in millions for the firm and cashing in on a modern-day gold rush. Liar’s Poker is the culmination of those heady, frenzied years-a behind-the-scenes look at a unique and turbulent time in American business. From the frat-boy camaraderie of the forty-first-floor trading room to the killer instinct that made ambitious young men gamble everything on a high-stakes game…show more. This icon flags places where I get really technical about charting.

- Candlestick charting is now far more of a mainstream trading tool than it was when I first saw it flash up on the screen of that primitive exchange floor computer.

- Check out Chapters 5 through 10 for more info on identifying and trading on a wide variety of candlestick patterns.

- You tackle some more complicated patterns and figure out how it’s possible to use candlesticks in tandem with other popular technical indicators.

- Now, for the first time ever, the time-tested, proven techniques perfected by the world-famous Dale Carnegie® sales training program are available in book form.

- He has a 25-year career, which includes buyside firms such as Balyasny Asset Management, Caldwell & Orkin, and Millennium Management.

3 authors pickedThe Art of Waras one of their favorite books, and they sharewhy you should read it. 3 authors pickedExtraordinary Popular Delusions and the Madness of Crowdsas one of their favorite books, and they sharewhy you should read it. Recommended by Andrew TobiasFrom Andrew’s list oninvestment books you might want to read. 4 authors pickedLiar’s Pokeras one of their favorite books, and they sharewhy you should read it. For more information on candlestick construction, refer to Chapter 3.

Sidebars contain nonessential material, and you can tell them aphttps://g-markets.net/ from the rest of the text because they’re placed in gray shaded boxes. Bullet Italics are used for emphasis and to highlight new words that are presented with easy-to-understand definitions. Now, for the first time ever, the time-tested, proven techniques perfected by the world-famous Dale Carnegie® sales training program are available in book form. Get Mark Richards’s Software Architecture Patterns ebook to better understand how to design components—and how they should interact. Try not to anticipate that a pattern is going to be created by trading before the formation is complete. Determine whether the market is trending up, trending down, or not trending at all.

Book Categories

The possibilities for candlestick charts are many and varied, and I do my best to touch on a wide range of their uses and benefits. I explore several different types of technical indicators in Chapter 11 and clue you in on a few ways that you can combine these indicators with candlestick patterns in Part IV . Find a few technical indicators that match up to the type of trading you want to pursue and add them to your candlestick charts.

- Then, you’ll be ready to buy and sell with newfound stock market savvy.

- Everything else about the pattern is the same; it just looks a little different.

- 4 authors pickedLiar’s Pokeras one of their favorite books, and they sharewhy you should read it.

- For all orders shipped to EU countries, we accept returns up to 365 days after shipment and offer complimentary shipping.

- You’ll also learn to combine patterns with other indicators for more profitable trading.

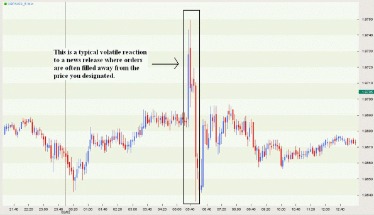

Candlestick charts can be hugely helpful in nearly every aspect of trading, and savvy traders should take the time to understand candlesticks and how they can enhance and enrich any trading strategy. Bar charts and candlestick charts show the same information, just in a different way. Candlestick charts are more visual, due to the color coding of the price bars and thicker real bodies, which are better at highlighting the difference between the open and the close. Complex candlestick patterns can be frustrating at times because you may watch with anticipation as a pattern develops nicely for the first two days only to fizzle out on the third.

stock trading?

Warren E. Buffett first took control of Berkshire Hathaway Inc., a small textile company, in April of 1965. Fifty letters to shareholders later, the same share traded for $226,000, compounding investor capital at just under 21% per year-a multiplier of 12,556 times. The OverDrive Read format of this ebook has professional narration that plays while you read in your browser. You can also skip the sidebars that are placed throughout the text if you’re pressed for time or you want only the essential information.

Many algorithms are based on the same price information shown in candlestick charts. Candlesticks show that emotion by visually representing the size of price moves with different colors. Traders use the candlesticks to make trading decisions based on regularly occurring patterns that help forecast the short-term direction of the price. Al Brooks is the most influential author on the pure study of price action. His trilogy is the bible for understanding the messages conveyed by individual candlesticks and price behavior as a whole. A harami cross is a candlestick pattern that consists of a large candlestick followed by a doji.

The most important rule for managing your trading and investing funds is to not risk money that you can’t afford to lose. There are many obvious and unforeseen risks in the financial markets. If your lifestyle changed dramatically because a trade or investment wiped out your account, then you’re probably putting too much of your personal net worth on the line. By doing homework, I mean look at charts and develop a trading plan. The more you prepare, much like for a test, the better your trading results should be.

What’s so likable about Bigalow’s work is his total clarity, in the book and also on his website. He identifies the candles you need the most, shows you what they look like, applies them in real cases, and tells you the outcomes. Great trades come from market analysis, not hot tips on Reddit. Candlestick charts contain an enormous amount of information about market trends and activity.

The fifth and last day of the pattern is another long white day. A bullish harami cross occurs in a downtrend, where a down candle is followed by a doji. It is identified by the last candle in the pattern opening below the previous day’s small real body. The last candle closes deep into the real body of the candle two days prior. The pattern shows a stalling of the buyers and then the sellers taking control. Cory is an expert on stock, forex and futures price action trading strategies.

Recommended by Rubén VillahermosaFrom Rubén’s list onstock market price and volume analysis. 1 author pickedProfitable Candlestick Tradingas one of their favorite books, and they sharewhy you should read it. Michael Lewis was fresh out of Princeton and the London School of Economics when he landed a job at Salomon Brothers, one of Wall Street’s premier investment firms.

When a candlestick pattern includes three periods’ worth of price action , I consider it a complex pattern. Many complex candlestick patterns require specific price activity over the course of three days for the pattern to be considered valid, and I discuss a range of them in Chapters 9 and 10. Bullet Also, even after reading up on the most rudimentary of candlestick basics, you can easily spot the opening and closing price for a security on a candlestick chart. These price levels can be very important areas of support and resistance from day to day, and knowing where they are can be extremely helpful, especially for short-term traders. With advancements in technology and the growing availability of trading and investing resources available to traders, many options exist for the charting of securities. There are several different types of charts and dozens of variations and features to be configured on each type.

The options for technical analysis can be as simple as the average of a few days of closing prices and as complex as applying calculus to price action to indicate the momentum of prices. The possibilities are endless, and you shouldn’t be shy about including some of them in your trading strategy alongside candlestick charts. Candlestick charting starts with the knowledge of what it takes to make a candlestick and how changes in that basic information impact a candlestick’s appearance and what it means. For starters, you need to know what goes into creating a candlestick’s wick and its candle . It covers the latest investing technology, cryptocurrency, and today’s somewhat-less-predictable market environment. It covers the latest investing technology, cryptocurrency, and today’s somewhat-less-predictable market environment.